It is likely you have felt a personal responsibility to reduce your carbon footprint. Perhaps you are avoiding flying? Or maybe you have cut down your meat consumption? However small, our environmental choices are all essential forms of climate adaptation. But while individual action is extremely valuable, we must also get corporates on board to drive widespread climate action.

The term ‘carbon footprint’ refers to the amount of greenhouse gas emissions associated with a specific person, entity or organisation (1). For a company, activities spanning from the global shipment of goods to printing a sheet of A4 all contribute to its carbon footprint. Reducing emissions may seem like an impossible mountain to climb yet, encouragingly, recent years have marked a shift: many companies are on a mission to limit their carbon footprints. Reflecting on this transition, our CEO, Ana Haurie, said:

“Corporates are no longer just feeling the top-down pressure to incorporate sustainability strategies into their operations, but also now face substantial and sustained bottom-up social pressure, which has resulted in them taking real action on climate.”

In this fight against environmental change, words and pledges are not enough; corporates must actively take steps to counterbalance their carbon footprint if they are to create genuine, tangible benefits for both people and the planet. Here’s how they can do it.

Net zero: Now is the time

There is growing consensus that we must reach a state of net zero by 2050 following substantial actions to reduce and mitigate existing unavoidable emissions before 2030. At the global level, the IPCC provides a clear definition of net zero, stating that: ‘Emissions reach net zero when all greenhouse gases emitted from human activity are counteracted by greenhouse removals over a specified period’.

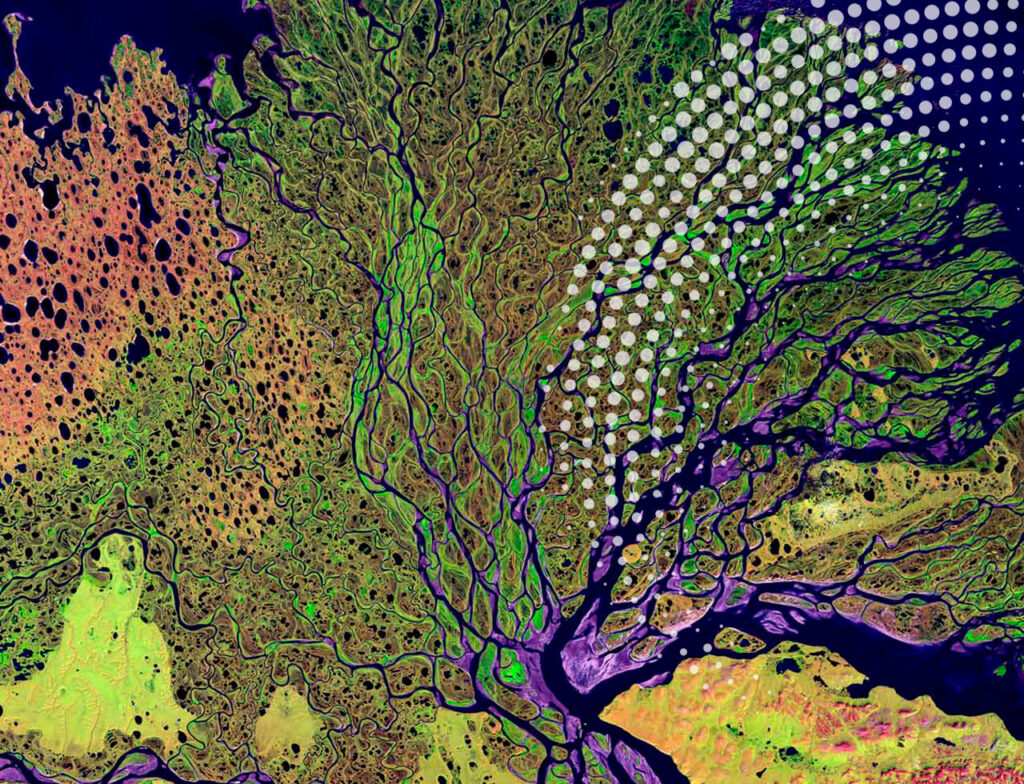

To reach net zero by 2050, we need to have already cut global emissions by approximately 55% by 2030 and such reductions cannot be achieved without also tackling the nature loss crisis. The earth’s natural ecosystems absorb roughly half of all anthropogenic carbon emissions, yet extensive deforestation is undermining the capacity of nature to provide climate change mitigation. If the intrinsic value of nature were not enough reason to invest in its conservation, the reality is that without natural biodiversity, our climate change trajectory would be far worse.

We are not yet close to counterbalancing our greenhouse gas emissions or to halting nature loss. At our current rate, temperature rise is set to reach 2.5°C above pre-industrial levels by 2050. Exceeding the 1.5°C limit agreed in Paris will likely initiate catastrophic positive feedback loops that once begun, will further increase global temperatures. Such threats including sea level rise, melting permafrost and more frequent, severe extreme weather events, underline the urgency with which we must act. Now is the time for corporate commitment net zero.

Counterbalance: The corporate responsibility

At a corporate level, net zero is less clear cut and can mean different things for different industries. However, for most companies, net zero is an end-state in which it has reduced its own internal – scope one and two – emissions and its product -scope three – emissions as much as possible.

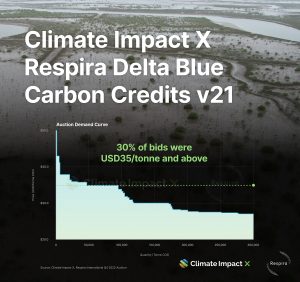

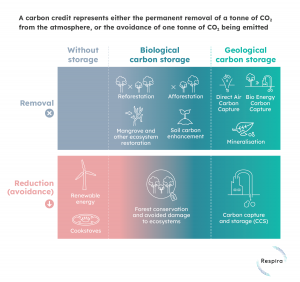

It’s clear we have no time to lose. We do not have the luxury to wait for new removal technologies still undergoing development. Instead, companies must deploy every tool currently at their disposal to achieve emission reduction goals. One resource already in our collective armouries are carbon credits. Representing either the permanent removal of a tonne of CO2 from the atmosphere, or the avoidance of one tonne of CO2 being emitted, verified carbon credits are proven to be an effective way to finance the protection of natural ecosystems while also enabling companies to achieve ambitious climate goals.

For this, nature-based credits hold particularly great potential. These solutions work with nature to address the climate crisis through projects such as forest conservation, soil restoration and blue carbon initiatives which not only sequester carbon from the atmosphere, but simultaneously protect nature and biodiversity.

When engaged with responsibly (more on this below), the voluntary carbon market is an effective tool for the acceleration of climate mitigation efforts. Let’s be clear, carbon credits form just one part of the climate solutions, but we see the scaling of the voluntary carbon credit market – and nature-based climate solutions in particular – as a prerequisite for a credible and ultimately successful journey to net zero.

How does this work in practice?

First of all, any company looking to work towards 2030 and 2050 targets should embark on a ‘pathway to net zero’. This refers to the plan a company must execute to reach the end-state of net zero emissions in a specified timeframe. Carbon credits must not be used in isolation, they need to be part of this transition pathway (see graph below). Typically, this involves a detailed account of how emission reductions will be achieved, accompanied by firm interim targets for when these reductions should be achieved. In fact, setting and meeting ambitious interim milestones could be said to be of greater importance for climate action than the end-goal of net zero. See Steps 1 and 2 on the graph below.

Once a company has committed to a net zero pathway, it should start to cut emissions from across its value chain inline with the mitigation hierarchy. However, even after the hierarchy has been followed, it is likely that a company will still be producing some unavoidable emissions. Step 3 of the chart outlines the most appropriate action for counterbalancing hard-to-abate, residual emissions. In this scenario, purchasing a corresponding volume of avoidance credits can provide a practical, short-term solution. Generated from projects such as forest conservation or clean cooking, avoidance credits help finance climate solutions and reverse nature loss. While this is vital in the near term, these credits cannot be an end state because a tonne of emitted carbon has not been removed from the atmosphere; a separate tonne has been avoided.

Avoidance and removal

This is why a company should transition over time to increase its purchase of removal credits (i.e generated when carbon dioxide is sequestered from the atmosphere and stored either biologically in trees or soil, or geologically through direct air capture and storage). Throughout this process, a company should be continually reviewing emissions across its value chain to see if they can be cut further.

As an impact-driven carbon finance company, our high-quality carbon credits allow corporations and financial institutions to mitigate their environmental impact while channelling private capital into predominantly nature-based climate solutions. Our flagship portfolio offers a balance of avoidance and removals projects which enable companies to follow a high-integrity pathway to net zero and counterbalance their carbon footprint. To learn more about our work and our portfolio, be sure to follow this link.

(1) https://www.britannica.com/science/carbon-footprint