With Climate Week NYC (CWNYC) just around the corner, now is the time for the data centre ecosystem to grow its positive impact on climate, nature, biodiversity and communities.

Here at Respira, we are looking forward to attending Climate Week NYC (CWNYC) to engage with events on nature and finance. Of the CWNYC’s ten themes, these two are directly relevant to our mission – channelling finance to predominantly nature-based projects to help mitigate the climate and nature crises.

The data centre sector is pivotal to the climate conversation. As the bedrock of modern commerce and with demand for digital services accelerating, data centres are predicted to emit 3.2 per cent of global emissions by 2025. This will greatly impact all hyperscalers, colocation businesses and enterprises in the sector.

Google, AWS, Microsoft and others have made significant net-zero commitments. The sector has already made great leaps in terms of power, heat and water efficiency. Scope 2 emissions (generated from the electricity used by the facility) can be addressed by purchasing voluntary carbon credits, or renewable power – typically generated onsite, under corporate power purchase agreements (PPAs) or via the market (together with certificates of origin). This is all broadly positive.

However, Scope 3 emissions (which include emissions along the entire supply chain – construction through to client emissions) can be as much as 50x that of Scope 1 and 2, and cannot be covered by PPAs.

Demand for AI and cloud computing is growing. This, combined with innovations requiring rapid data transfers (lower latency) and the movement of infrastructure closer to cities and people (edge computing), will all increase emissions and likely decrease energy efficiency.

But all is not lost – by investing in nature, the entire data centre supply chain can directly contribute towards the UN SDGs[1] and tackle Scope 3 emissions. As the sector scales and grows its footprint, data centres can reach environmental ‘cloud 9’ (pun absolutely intended). Mitigation is possible; it’s just a matter of knowing where to look (hint, following nature and finance talks at CWNYC is a great place to start).

Data needs nature

We all know that humans are drastically altering the Earth’s climate. There’s no denying it, climate and nature are in crisis – and that means business is too.

Increasingly frequent and severe extreme weather events already cost many billions of dollars and with more than 55 percent of global GDP dependent on nature, its degradation is already taking a significant economic toll. To avert environmental and economic catastrophe, it is widely agreed that we must reach a net-zero scenario by 2050. This means taking substantial steps to cut emissions before 2030.

To enable growth, data centres need an intermediate strategy to mitigate their environmental toll. Here, nature-based solutions such as forest conservation and restoration, have an important part to play. While we wait for technology, such as direct air capture, to be improved and effectively scaled, we need to leverage the power of nature to capture and store CO2. Again, hyperscalers like Microsoft are leading the way, as exemplified by their recent collaboration with Toroto.

Why make climate mitigation harder by cutting down our natural carbon sinks? Why exacerbate the nature crisis by destroying biodiverse habitats? Carbon credit-generating, nature-based projects can protect these precious resources while simultaneously supporting essential, but highly polluting, industries as they reduce their emissions.

Reduce and invest

At Respira, we back projects that remove additional carbon from the atmosphere (think reforestation) and those which reduce the volumes emitted in the first place (think conservation). New trees don’t sequester large volumes of carbon immediately so this approach means we are both protecting what we have and preparing for the future.

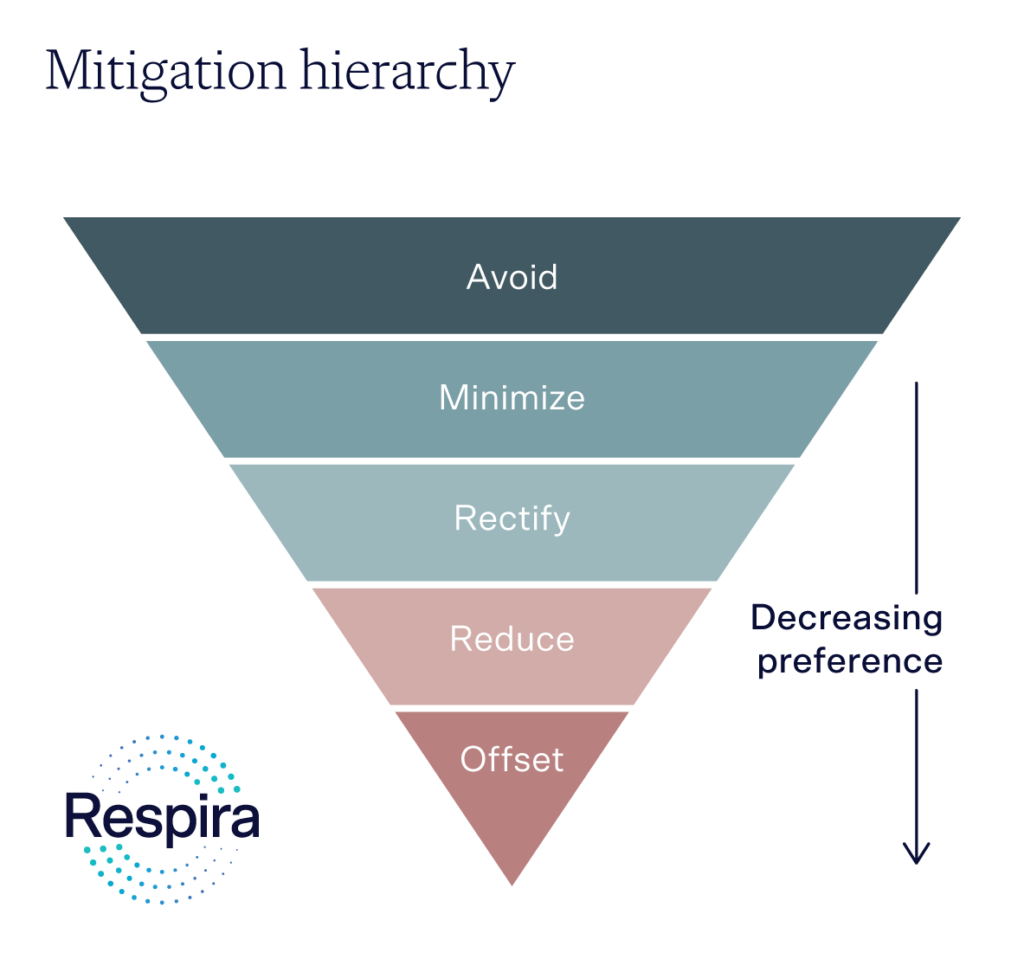

So what is the most effective way to invest in nature? The mitigation hierarchy is an essential resource for any company entering the voluntary carbon market. It is based on the theory that carbon crediting is the least preferential action a company can take on its pathway to net zero. Companies must reduce first, then invest.

MITIGATION HIERARCHY: Companies should reduce first, then invest.

First, companies should avoid emissions wherever possible. Next, they should reduce all emissions that cannot be totally avoided. After that, a company should reconsider its definition of ‘essential emissions’ as more can likely be cut than originally calculated and then reduce emissions again across the entire supply chain. Then, and only then, should any investment be made into high-quality removal and reduction credits.

Nature needs finance

There’s no path to net zero without nature-based solutions. However, these vital climate mitigation projects are currently severely lacking in funding. There’s currently an estimated US $382 billion funding gap between that which is delivered to nature-based solutions and the levels required by 2030. To fill this gap, we need companies to balance their books.

What does this mean in practice? Put simply, companies should match their emissions to equivalent investments in the voluntary carbon market. If you pollute; you pay [2] and as you reduce emissions, you reduce your investment.

However, this does not mean buying any carbon credit for they are not all created equal. Companies must do thorough due diligence to ensure their investment leads to real, tangible and positive impacts on the climate, people and biodiversity.

Respira has, and will continue to carry out due diligence on behalf of our clients. Our team of conservation, carbon and finance experts source certified projects directly and continually monitor their progress, working closely with trusted developers to identify and mitigate risks (whether they be operational, social, environmental, or political) bringing high-quality credits to market. Our existing portfolio of projects have passed our due diligence processes and already received investment, and can therefore immediately form part of your social impact or net-zero strategy.

Respira are in the process of building a global buyers’ coalition called Vivair, which will allow investors (referred to as members) to secure a future supply of high-quality carbon credits. A supply-demand imbalance is brewing and many expect the market will be short of carbon credits by 2030 as companies fall short of net-zero commitments.

By entering into long-term and affordable fixed contracts, Vivair’s members are insulated from this market risk. Unlike other buyers’ coalitions which run a procurement process for its members (namely Symbiosis, which was formed by Google, Microsoft, Meta and Salesforce earlier this summer) Respira’s origination team will deploy the money raised from Vivair’s members to generate and then distribute the credits back across the membership. This is a good option for companies who want direct input into the portfolio’s composition.

Respira facilitates immediate, effective progress towards a global state of net zero emissions. Capital is a catalyst; to scale effective climate mitigation we need companies to engage with the voluntary carbon market to fund vital conservation and restoration projects. This is not a box-ticking exercise. It’s about your business taking a positive, measured and proactive stride towards net-zero, and facilitating future growth by investing in nature.

Market leaders are already reducing and investing (and defining customer expectations in the process!) to get ahead, we urge data centres to engage with CWNYC this year. It is a chance to learn more about nature and finance and a golden opportunity to accelerate your net zero journey.

[1] Namely UNSDG #9 Industry, innovation and infrastructure, #11 Sustainable cities and communities, #12 Responsible consumption and production, #13 Climate action

[2] AP reports that a study has found the most successful policies for cutting emissions are those which set a price for pollution.

Picture credit: NASA via Unsplash

Share this article