It is often said that a bad workman blames their tools. As with many old proverbs, this saying does contain a morsel of truth, especially when applied to the voluntary carbon market.

Recently, we have seen more cases of criticism directed at carbon credits and those who use them. But this is not always justified; it is not the credits themselves which are to blame. They are simply a mechanism which – when used wisely – can drive action for climate and nature.

So while critics are busy accusing companies of using carbon credits to avoid meaningfully reducing emissions, a study has been quietly investigating the reality of this claim. Its findings revealed this statement to be far from the truth – it reported a positive correlation between an investment in carbon credits and the speed with which a company decarbonises.

So if it’s not the carbon credits themselves, then what can go wrong? Issues can arise during both the supply and the demand stages, so it’s important to understand what constitutes best practice. Choosing the best solution is challenging, particularly if you are new to the market, so here we outline the key traits which define high quality supply of, and high integrity demand for carbon credits.

HIGH-QUALITY SUPPLY

In many ways, the success of including carbon credits within a corporate net zero strategy is determined long before a company decides to counterbalance their emissions. Ultimately, success is reliant upon the original quality of the credit supply which places a lot of responsibility on the shoulders of carbon project developers.

Firstly, developers must ensure that their project – be it forest conservation or mangrove restoration – would not have been possible without carbon finance. Only if credits are generated from an activity that would not otherwise be possible, can a project be classed as ‘additional’. When searching for high quality, it is essential that buyers check if a project’s additionality is verified.

Project developers should also take every precaution to ensure the benefits of their project are long-lasting. This applies, not just to its potential for climate mitigation, but also to any beyond-carbon benefits it offers to local people and the surrounding biodiversity. If a project’s impacts are short lived, it is not possible to consider its credits high quality.

The good news is that the voluntary carbon market is increasingly regulated. Buyers should always look to see if carbon credits are verified before they purchase. This means that any advertised emissions reductions have been measured and accounted for by an independent third-party agency. This includes analysis of the scientific methodologies used to calculate project baselines and regular surveillance of project areas. Emerging ‘nature tech’ is already paving the way for increasingly reliable verification across the carbon markets.

There is also increasing guidance available to help buyers understand the characteristics of high quality carbon credits. For example, earlier this year, the IC-VCM released the much-anticipated Core Carbon Principles to set a minimum criteria for high quality carbon credits. This will help corporates to evaluate credits prior to purchase and ensure that they are engaging with climate solutions which bring genuine, long-lasting benefits.

HIGH-INTEGRITY DEMAND

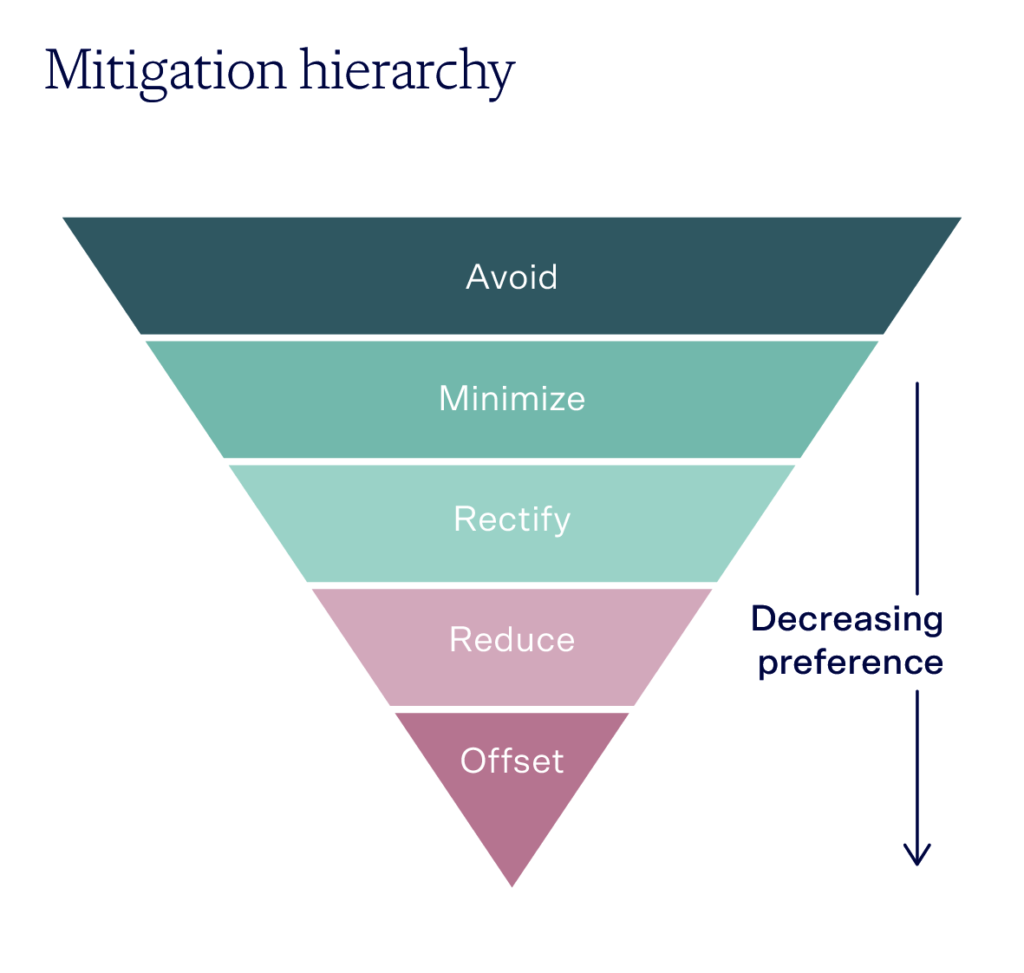

However high the supply-side quality, credits cannot drive meaningful climate action unless the demand side operates with integrity. Corporates are encouraged to follow the mitigation hierarchy when considering using carbon credits to support their environmental action. This model advises that carbon credits are purchased only after every effort has been made to cut emissions from across the company’s value chain.

Recent years have seen growth, both due to mandatory disclosure and reporting initiatives such as the TCFD, and from the voluntary carbon market. More than 3,000 corporations have so far set net zero targets and are increasingly motivated to demonstrate their climate credentials to end consumers. This means many more are opting to voluntarily purchase credits to counterbalance their residual emissions in the near to medium term.

As more corporates are turning to carbon credits, organisations such as the VCMI focuses on regulating the environmental claims which can be made following purchase. Its work on the Provisional Claims Code of Practice is designed to address allegations of greenwashing and to ensure any claims made are entirely science-based and credible.

Speaking of the growing body of regulation and guidance, our Director of Business Development Will Close-Brooks said:

“If we take all of these together, we see an increasingly robust foundation from which the market can grow with integrity over the coming years.”

Indeed, operating under these guidelines, carbon credits are truly a mechanism to celebrate. Sourced from high quality projects and implemented with integrity, they hold enormous potential to drive climate action.

Picture credit: Delta Blue Carbon, Indus Delta Capital

Share this article